Indice dei contenuti

ToggleThat the robotics market, especially that collaborative And mobile, it was expanding was already evident from the trends of recent years, under the post-pandemic push which saw sales data skyrocket precisely during 2021.

2023, for its part, is shaping up to be a key year for the industrial automation sector.

This is based on the optimism dictated by recent data on robotics, especially collaborative, which is revealed growing despite a limping global macroeconomic situation.

According to some data processed by the study Global Collaborative Robots Market Size, Share & Industry Trends Analysis Of ReportLinkerIn fact, between now and 2028 the global market for collaborative robots should achieve annual growth of 40.1%, thus reaching the 10.8 billion dollars.

But the exceptional fact is another.

Although there are many operational applications in which robotic and collaborative robotics solutions find ample space, among those most clearly in development stands out movement of goods.

In a logistics that requires ever greater speed, with the hand forced above all by the logic of a buzzing and constantly evolving e-commerce market, parcels need to "travel" as quickly as possible.

This is why companies are looking for solutions that can reduce times and optimize results, trying to eliminate the human error factor.

It is precisely on the basis of these considerations that the Interact Analysis predictions, therefore, provide the key data.

A fact that producers, developers and integrators have posted and circled in red on their noticeboards: it is estimated that in 2026 the volume of small parcels processed each year in warehouses around the world will reach 266 billion units, exactly double the figure two years ago.

The market speaks clearly.

The ones who will govern this growth will be the Mobile Robots, robotics solutions capable of moving autonomously in corporate environments and, when also equipped with collaborative arms, capable of adapting to any operational context.

In this context, we expect strong growth in the coming years, with an increase in sales (both in industrial and non-industrial sectors) and the development of new application scenarios but, above all, a great deal of excitement in the market that exists today dynamic but extremely fragmented.

The current market scenario for Mobile Robots

The investigation conducted by Interact Analysis provides interesting indications about the current face of the market for mobile robotics solutions.

The starting point, we had already mentioned, is 2021, the year in which the industrial robot market is grew by 25% globally.

As far as mobile robots are concerned, it is clearly 2021 itself that has set a record: over 100 thousand units sold and an impressive leap in attendance in warehouses around the world.

We have practically gone from a few hundred specimens to an increase of 70% in just 18 months, with global turnover growing by 36% and market growth breaking down the barrier of 3 billion dollars.

Mobile robots, according to a report by Next Move Strategy Consulting, they also have one of the fastest growing markets in robotics, with a CAGR (Compound Annual Growth Rate) of 21%.

According to estimates from this report, the market value could even reach approx $72.5 billion by 2030.

China, the United States and Japan are setting the pace for the presence of mobile robotic units, but the phenomenon is spreading like wildfire across the entire global landscape.

In fact, Interact Analysis still tells us about a market in turmoil, with new suppliers entering the market every year and announcements of new acquisitions following one another without interruption.

All these indications can only predict a new breaking of the record set in 2021.

They tell you the estimates, in black and white: in 2025 they will be sold in the world 640 thousand "autonomous mobile robots" and 43 thousand "automated guided vehicles", with a global presence that will surpass two million mobile robots.

This data can only be linked to two factors:

- greater demand for automation and robotics in the most diverse sectors

- growing awareness of the advantages of mobile robotics even in areas other than the more traditional ones.

Dynamism and fragmentation of the market

Let's start with a necessary clarification, before better framing the picture of a market which, as we have anticipated, is dynamic but very fragmented.

When we talk about mobile robots, we must distinguish between:

- AGV (Automated Guided Vehicle), a machine that can only operate on a fixed path guided by wire or magnetic markers.

- AMR (Autonomous Mobile Robots) equipped with an intelligent navigation system through which it creates maps within its software, recognizes obstacles and can plan movements to avoid them.

- AMMR (Autonomous Mobile Manipulation Robot), a more sophisticated form of AMR because it is equipped with an arm for autonomous gripping and picking. Instead of simply carrying items, AMMRs can load and unload them themselves and even place them on designated shelves.

All 3 robotic solutions are currently used on a large scale forautomation of logistics warehouses, especially those of e-commerce, for their exceptional ability to optimize operational flows, making operations such as picking and packaging streamlined and rapid.

Do you remember that fact? 266 billion small parcels processed annually by 2026.

This is enough to motivate the excitement and dynamism of the reference market which sees a constant "appearance" of new players, characterized by the birth of new startups and the offer of AMR by companies already present in markets similar to that of mobile robotics .

But why are we talking about fragmented market?

The explanation is once again provided by Interact Analysis.

In 2021 top 10 mobile robot vendors they only collected the 36% of total revenues of the sector.

An extremely different figure compared to that recorded by the more mature market of industrial robots, where the top 10 suppliers own a large share of the 73% market. And the same thing goes for the one relating to collaborative robots, with the top 10 giants holding the 85% on the market.

Interpreting the data, it is precisely the continuous emergence of new competitors which would be preventing the consolidation of the sector. This is a trend already detected last year by Interact Analysis and reconfirmed by the most recent research, in which consolidation is excluded for at least another 2-3 years.

In addition to the multitude of competitors, however, there would also be the great vastness of types of robots, industries and applications which fit into the context of automation through Mobile Robots.

Not even them acquisitions, which, according to the data collected by Interact Analysis, follow one another continuously, are having a consolidation or concentration effect on revenues.

Over the last couple of years, for example, some major AMR suppliers, such as Fetch Robotics And ASTI Mobile Robotics, were acquired by other companies that, however, did not already have a portfolio of mobile robots.

The same applies to cases of acquisitions among mobile robot companies, which in turn did not have the effect of effectively consolidating the market, since the companies involved represented only a small percentage of the overall revenues of the sector.

Interact Analysis ultimately predicts that there will be more acquisitions in the future, especially by industrial companies eager to take advantage of the growth and high margins of the sector of mobile automation.

However, it is expected that these acquisitions will be made by companies that are not currently active in the industry. Potential buyers they could be retailers, logistics companies or large warehouse automation system integrators.

Whether it is good or bad remains subjective, or almost so.

For retailers and logistics companies, for example, being able to enter a market withsuch a vast offer it would mean being able to buy from multiple companies, choosing the best solution based on your operational needs.

The same goes for the systems integrators, who could offer their customers technologies from different robot suppliers, with all the attendants and connected. The only limit lies in the ability to make mixed robotic fleets work together, solving the challenges associated with using solutions from multiple suppliers.

The long wave of growth for startups

The market rules are rigid, but in this specific case they have yet to be written.

Perhaps this is also why the startups that have decided to invest in the design of mobile robotics solutions are doing well finding space and they do not yet risk being forced under the shadow of the great giants.

Again according to Interact Analysis data, for example, last year many AMR startups that successfully expanded their pilot projects produced revenues even exceeding 20 million dollars.

An example, to understand the scope of the phenomenon, is that of Locus Robotics.

We are talking about a startup, based in Wilmington, Massachusetts, that produces autonomous mobile robots designed to pick items from warehouses.

Well, under the guidance of the American investment company Tiger Global, the “LocusBots” of Locus Robotics have raised in a single round well 150 million dollars, bringing the company to value 1 billion dollars.

In this sector, Locus Robotics was therefore the first "unicorn" startup, i.e. capable of reducing the billion-dollar value, and this also under the pressure of the large increase in sales through e-commerce.

If this isn't foresight.

The Locus Robotics robots, so to speak, were purchased last September by DHL, which approved its entry into the fleet for well 2 thousand units.

Application trends and advantages of “collaborative”

According to Interact Analysis report, in 2022, more than half of all global industrial robot sales will come from two main applications: movement And welding.

The triggering factor is certainly the e-commerce boom, which have caused the data on parcels to skyrocket, especially small and medium-sized ones, which need to be moved within logistics warehouses.

We know the data, but repetita iuvant: 266 billion small parcels processed annually by 2026.

In this context the Collaborative robotics comes in great help.

The application of collaborative robotic arms to mobile robotics solutions, in fact, makes the machines completely autonomous and able to work in total safety within spaces in which human operators move simultaneously.

Mobile collaborative robotics, therefore, will ride the market and represent the most suitable integrated solution for companies that want to invest in such a rapidly expanding mobile automation market.

The same goes for welding operations, whose "robotic" execution reduces the risks associated with injuries at work and solves the big problem of labor shortage.

But the trends in the use of these machines remain in continuous evolution, with all the repetitive, heavy and dangerous operations, which require speed and efficiency, ready to be carried out by Mobile Collaborative Robots.

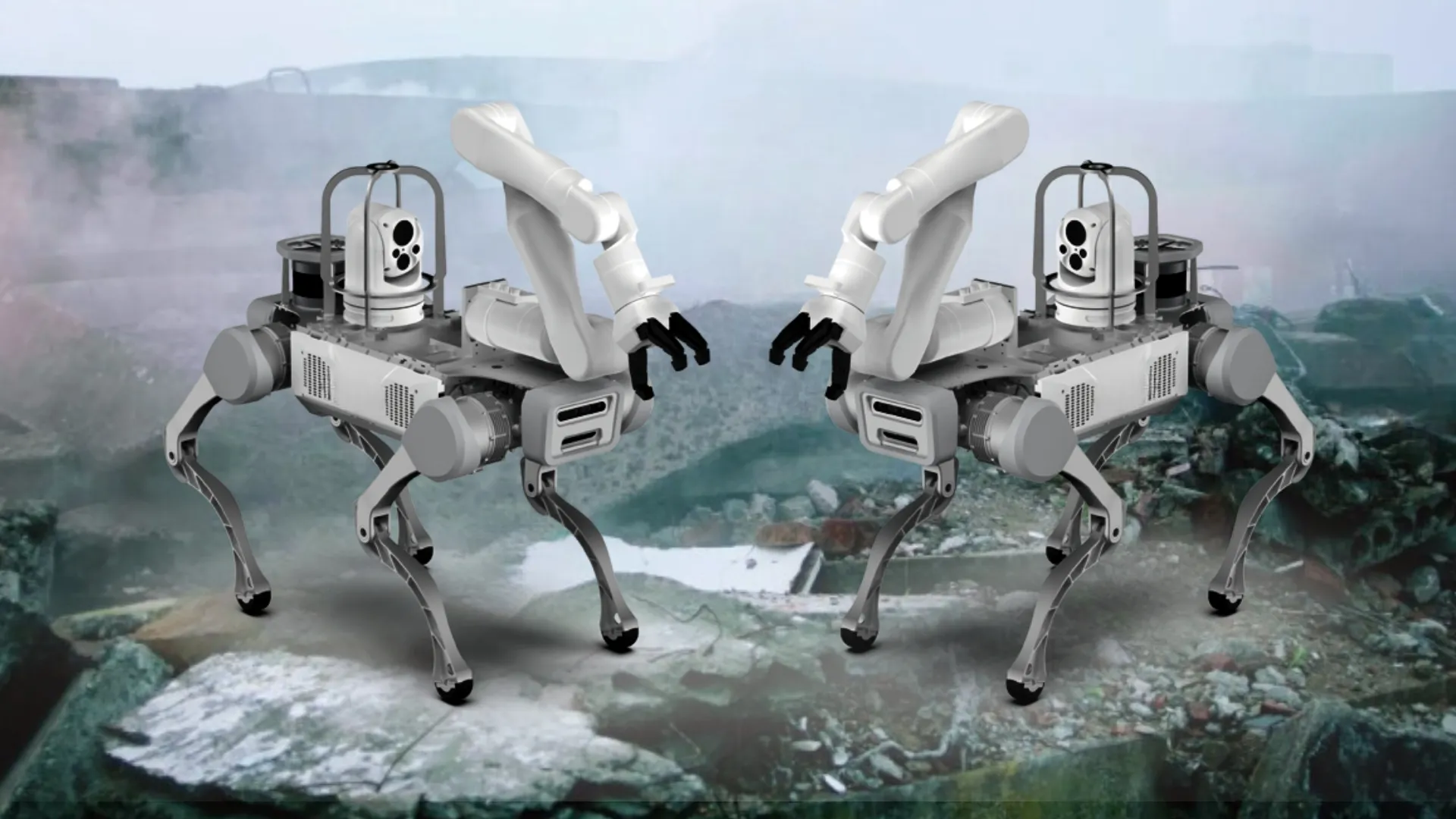

TOD System's mobile collaborative robotics solutions

Our mission is to design and develop robotic solutions flexible, modular and capable of solving every operational need for companies.

The fruits of our research and development work are therefore technologies that are inserted with full rights in such a dynamic market as that of mobile robots, riding among the pioneers of further progress.

From projects like ours todrobot TR1, for example, a solution is born mobile collaborative robotics truly revolutionary.

Autonomy, flexibility, efficiency and simplicity of management are the key words.

But the story doesn't end here, in fact, it has just begun.

Contact us to learn about all our automation solutions.